Let’s be honest. The finance team’s spreadsheet and the blockchain explorer feel like they’re from different planets. One’s orderly, governed by centuries of rules. The other is this wild, cryptographic frontier of digital assets, NFTs, and tokenized revenue streams. Getting them to talk? That’s the new, messy, and utterly crucial challenge for modern businesses.

Here’s the deal: whether you’re a gaming company holding Ethereum, a brand that minted an NFT collection, or a startup issuing revenue-sharing tokens, these assets have real value. They belong on the books. But traditional ledgers—and the accounting frameworks they follow—weren’t built for this. So, how do you bridge the gap without breaking GAAP or IFRS?

The Core Problem: Where Does This “Thing” Even Go?

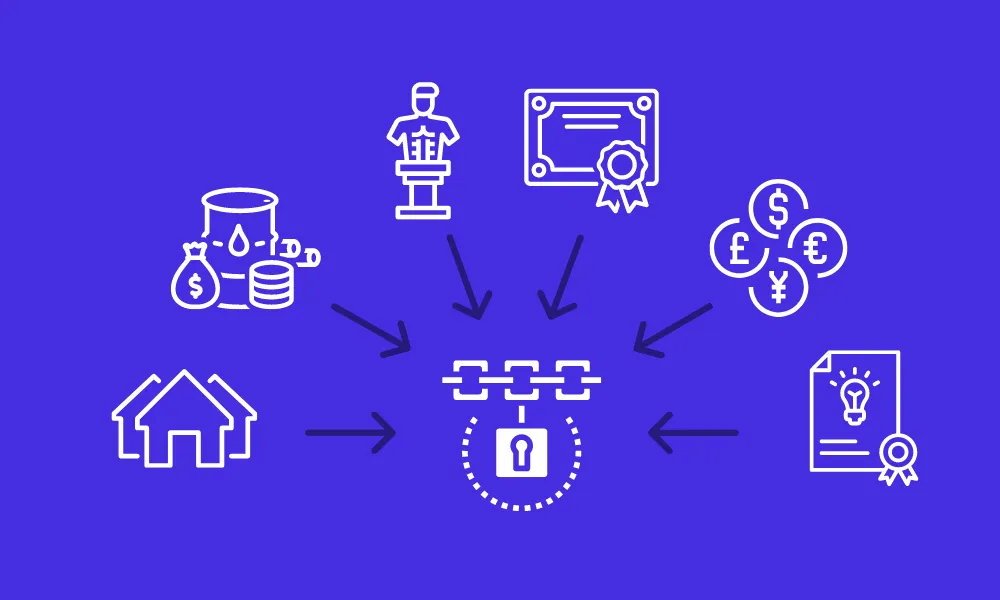

First, you’ve got to figure out what you actually have. It’s not just “crypto.” The accounting treatment varies wildly based on the asset’s nature and your intent. Think of it like classifying animals. A dog, a goldfish, and a butterfly are all living creatures, but you wouldn’t house or care for them the same way.

1. Digital Assets (Cryptocurrencies like Bitcoin, Ethereum)

Under most traditional frameworks (like U.S. GAAP), these are typically treated as indefinite-lived intangible assets. That’s a mouthful, but it means something specific: you record them at cost, and then only write them down if their market value drops below cost. You can’t write them up when the price skyrockets. Feels a bit off, right? It captures the loss but not the gain until you sell.

Pain point alert: This creates volatility in your financials during crypto winters, even if you’re a long-term holder. The accounting doesn’t reflect the economic reality many believe in. Some companies with treasury assets are pushing for “digital asset” specific guidance, but for now, the intangible model reigns.

2. Non-Fungible Tokens (NFTs)

This is where it gets fun. An NFT could be a few things, honestly. Is it a piece of digital art (an intangible asset)? A license key for access to an event or community (a prepaid expense or license)? Or maybe it’s inventory—like if you’re a gallery minting and selling them. The accounting hinges entirely on its utility and your business model.

If you hold a Bored Ape as a brand asset, it’s likely an intangible. But if you’re generating royalties from secondary sales of an NFT you created? That’s a whole new revenue stream to recognize—often as the sales occur on-chain, in real-time. Tracking that manually? A nightmare.

3. Tokenized Revenue & Assets

This is the cutting edge. Imagine selling a percentage of future royalties from a song, or tokenizing a piece of real estate. The token represents a financial right. Is it debt? Equity? A simple receivable? The classification drives everything: balance sheet placement, revenue recognition, and tax implications.

Well, the key is to look at the underlying economic obligation. Does the token holder get a fixed return? That smells like debt. Do they share in the profits and risks? That leans toward equity. It’s complex, and honestly, many are figuring it out as they build.

Practical Steps for Your Traditional Ledger

Okay, so theory is one thing. Actually doing the books is another. Let’s dive into some practical steps to bring this chaos into order.

Step 1: Establish Clear Custody & Internal Controls

Who holds the private keys? How are transactions approved? This is your foundational internal control—the equivalent of locking the cash drawer. Without it, you can’t reliably audit anything. Use multi-signature wallets and strict governance policies from day one.

Step 2: Choose Your Valuation Method & Stick to It

Mark-to-market? Cost? You need a consistent policy. For liquid assets, many use a reputable exchange’s price at period-end. For illiquid NFTs, you might need models or third-party appraisals. Document your methodology. Seriously, this is non-negotiable for auditors.

Step 3: Map the On-Chain Activity to Journal Entries

This is the manual grind. Every wallet interaction—a purchase, a sale, a gas fee, a royalty earned—is a potential journal entry.

| On-Chain Action | Potential Journal Entry (Simplified) |

| Purchase 1 ETH for $2,500 | Dr. Digital Asset $2,500 | Cr. Cash $2,500 |

| Pay $50 network (gas) fee | Dr. Transaction Fee Expense $50 | Cr. Digital Asset (ETH) $50 |

| Receive 0.1 ETH royalty payment | Dr. Digital Asset $250 | Cr. Royalty Revenue $250 |

You can see how this scales into a problem. Automation isn’t a luxury; it’s becoming essential.

Step 4: Disclosure, Disclosure, Disclosure

Even if the numbers on the balance sheet look simple, the notes to the financial statements will need to tell the full story. Your accounting policies, the risks (volatility, regulatory, custody), and the fair value details—it all needs to be transparent. Think of it as providing the map to your treasury’s new, digital wing.

The Tech Bridge: Software & Automation

Doing this with Excel and manual journal entries is… well, it’s a fast track to errors and auditor pushback. A new category of software is emerging to help. These tools connect to your wallets via APIs, automatically pull in transactions, classify them, and even suggest journal entries for export into your general ledger (like QuickBooks, NetSuite, or Xero).

They’re not perfect yet, but they handle the heavy lifting of data aggregation and normalization. That frees your team to focus on interpretation, policy, and control—the actual accounting, not the data entry.

A Thought-Provoking Conclusion

The tension here is more than just technical. It’s philosophical. Traditional accounting seeks to be conservative, objective, and verifiable. The blockchain world is about real-time transparency, programmability, and often, speculative value.

For now, we’re fitting square pegs into round holes, using frameworks designed for physical factories to account for digital deeds and programmable revenue. The rules will catch up, eventually. But in the meantime, the businesses that thrive will be those that build rigorous, auditable bridges between the old world of ledgers and the new world of ledgers—the distributed ones. They won’t just account for these assets; they’ll understand their story well enough to tell it clearly, to both their accountants and their investors.